Analysing Your Portfolio for 2024: A Practical Approach

As we head into 2024, it’s a great time to review your investment portfolio. Have you noticed India’s rapid economic growth? At present, India stands as the quickest-expanding major economy across the globe.

In 2023-24, India’s nominal GDP is estimated to hit Rs. 301.75 trillion (US$ 3.62 trillion), reflecting an evolving economy. For you, as an investor, this spells opportunity.

Keep reading to find out how to incorporate Indian markets into your investment portfolio for balanced growth.

Importance of Regular Portfolio Analysis

As you venture into 2024, I’ll tell you why regularly analysing your portfolio is as crucial as your initial investment decision:

Optimising Asset Allocation and Stock Selection

Asset allocation is about distributing your investments across different types of assets. Typically, this involves a mix of various asset types like stocks, bonds, and cash or equivalents in money markets. In India, stocks are often categorised by their market size.

Beyond stocks, your investment mix can include:

- High-yield Savings Accounts

- Short-term Certificates of Deposit (CDs)

- Bonds

- Short-term Corporate Bond Funds

- Dividend Stock Funds

Adapting to Changing Market Conditions

The post-COVID-19 landscape and ongoing geopolitical tensions have significantly impacted global markets.

Remember how in 2021, when the world began to reopen, the stock market saw a robust recovery? But then came 2022, with its mix of pandemic responses from China, U.S. political tensions, and other global issues.

These developments caused Wall Street to have its toughest year since the 2008 financial downturn. Fast forward to 2023, and the impact of COVID-19 on the stock market has lessened, but the landscape remains complex.

Understanding Market Trends and Economic Cycles

Keeping a close watch on market trends and the economy’s ups and downs is essential, especially when you’re nurturing an investment portfolio on a budget.

Image Source: corporatefinanceinstitute.com

Think of the economic cycle as the heartbeat of the country’s financial health. Sometimes it’s strong and steady, with growth and prosperity (like a boom). At other times, it’s weaker, reflecting a slowdown (recession).

Image Source: researchgate.net

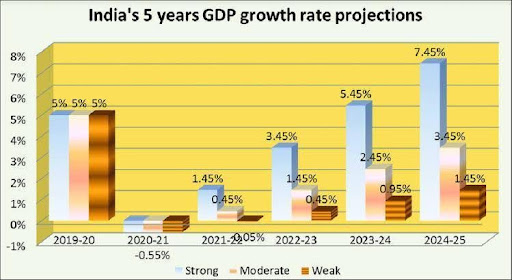

In India, the forecast for GDP growth hovers around a healthy 6.5% in the fiscal years 2024 and 2025. This promising figure indicates that the economy is on an upswing, which could spell good news for your investments. By understanding these patterns, you can make smarter choices – like when to invest more aggressively or when to hold back.

How to Prepare Your Portfolio

Let’s explore the steps to prepare your portfolio, ensuring it is well-positioned for both present needs and future aspirations.

Step 1: Creating an Optimal Portfolio Structure

Start by designing a portfolio that reflects your expectations for 2024, taking into account the predicted market trends. For example, forecasts indicate that India’s stock market might rise over 10% by the end of 2024. In light of this, it’s crucial to consider various factors. These include economic growth, sector performance, and global market trends.

Step 2: Comparing and Updating Your Existing Portfolio

Examine your current investments and see how well they align with your newly structured portfolio. Look for gaps or areas needing improvement. For instance, sectors like fintech, IT and services, healthcare and insurance, electric vehicles and automobiles, renewable energy and climate tech, artificial intelligence (AI) and fast-moving consumer goods (FMCG) are expected to excel in 2024.

Adjusting your investments to include these areas can be beneficial. Similarly, reducing exposure to sectors that might underperform could be a wise move.

Step 3: Tailoring Strategy According to Life Stage

Your investment strategy should be customised to your stage in life. A young, unmarried college graduate at the start of their career will have a different investment approach compared to a 55-year-old planning for a child’s education and retirement.

The younger investor can take on more risk for higher returns, while the older investor should focus on asset protection and income generation.

Practical Tips and Tricks

Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market conditions. This reduces the risk of investing a large amount at the wrong time.

Stay Informed: Keep up with financial news and market trends. This helps you make informed decisions and spot opportunities.

Avoid Emotional Decisions: Don’t let fear or excitement drive your investment decisions. Stick to your strategy.

Diversify: Don’t put all your eggs in one basket. Spread your investments across different asset classes and sectors.

Final Thoughts

Monitoring your investments can be a challenging task. That’s where Appreciate steps in. Appreciate is a digital platform that simplifies investing in various assets, including US stocks, fixed deposits, ETFs, bonds, and digital gold. Appreciate online trading app help you see and manage your investments easily.

So, regularly looking at your portfolio is key to good investing. With tools like Appreciate, it’s easier to make smart choices and stay on top of your financial goals.

Author Bio: Yogesh is a Co-Founder at Appreciate, a fintech platform helping Indians achieve their financial goals through globally diversified one-click investing.